Now that you have found the right property to purchase you are bound to have a few questions about what to do next.

To assist you, we have compiled this Guide in an endeavour to answer the most frequently asked questions at this time and to give you a few ideas about the next stage of the process, which you will hopefully find helpful.

If at any stage you have any questions or concerns, please feel free to contact me to discuss these with me.

I welcome the opportunity to assist you at any stage and look forward to working with you to achieve a successful outcome.

Congratulations again and best wishes.

What Do We Do Next?

Following are the steps you will need to take over the next few days.

Steps 1-3: To be completed within 48 hours

Step 1

If you are borrowing money for this purchase, you need to immediately contact your loans officer at your bank or other financial institution to formalise your application. Unconditional /formal written approval sometimes takes a number of days to be prepared, so, even though you would already have had your loan approved conditionally, you should make contact as soon as possible.

Check with your loans officer on exactly what they will require.

Ask the bank whether they will require a valuation, and if so, what arrangements are being made for the valuation to be done. The valuer should contact our office directly for access arrangements.

Step 2

Most purchasers decide to obtain pre-purchase building and pest reports once their offer has been accepted. We can assist by supplying you names of appropriately licenced tradespeople who have carried out inspections for our purchasers in the past and of whom we have had positive feedback.

Building Inspection: a written account of the property’s condition by a licensed builder. It will include any significant building defects or problems such as rising damp and movement in the building.

Pest Inspection: a written report by a qualified pest inspector which will identify any visual damage that may have been caused by termites or other timber destroying pests.

Decide on a building and pest inspector and request them to undertake an inspection on your behalf.

Step 3

Phone your solicitor/conveyancer to advise them of your purchase and make an appointment to see them asap.

Please note that your contracts can actually be signed at any time up to this stage and can then be held by your solicitor until you are ready to exchange.

Steps 4 - 13: To be completed after approximately 7 days

Step 4

If you have not received your written loan approval within a week, I suggest you follow up by phoning the lending officer at your bank or financial institution.

Step 5

If you haven’t already, ensure you have received your building and pest reports, review them and if you have any concerns, please call me to discuss them. You would expect to have these reports 2 or 3 business days after the inspection has been done.

Step 6

By now you:

• have received formal advice of your loan approval from the bank

• are satisfied with the building report, if obtained

• are satisfied with the pest report, if obtained

• have arranged any other documentation your solicitor requested (eg strata inspection report, survey, building certificate)

You are now ready to formalise your purchase by exchanging contracts (your purchase agreement).

In the event that contracts have not been exchanged within a fourteen day period, the vendor may request that any other interested parties be given the opportunity to purchase the property.

Step 7

Pay the agreed deposit to John Mooney Real Estate Trust Account (PDF attached).

Step 8

Check with your solicitor that the contracts have exchanged. If there are problems, contact me so that I can follow up for you.

Step 9

Check stamp duty payment with your solicitor/conveyancer if applicable.

Step 10

Insurance. As a buyer, you may have an insurable risk over the property you are buying from the time of the exchange of contracts. It is not always safe to rely on insurance arranged by seller(s) - it is wise to take out your own insurance policy on the property. Contact your insurance company for more advice.

Step 11

Contracts become unconditional after 5 business day cooling of period if applicable – the sold sign will then go up!

Step 12

Make arrangements for your move. Eg. Contact removalist if required.

Step 13

Check notice period if leasing and give appropriate notice to agent.

Step 14: To be completed one week prior to settlement

Step 14:

On the day of, or the day before settlement you and I should arrange to meet at your new home to conduct a pre-settlement inspection.

Checklist for change of address

When moving house there are many things for you to attend to, and it is all too easy to overlook the need to advise various authorities and organisations of your change of address.

It might be of help to go through the following checklist and mark each item, which is relevant in your case. The list is not necessarily exhaustive, and you should add to it if necessary.

- Electricity

- Natural Gas or bottled gas if applicable

- Home landline /Internet

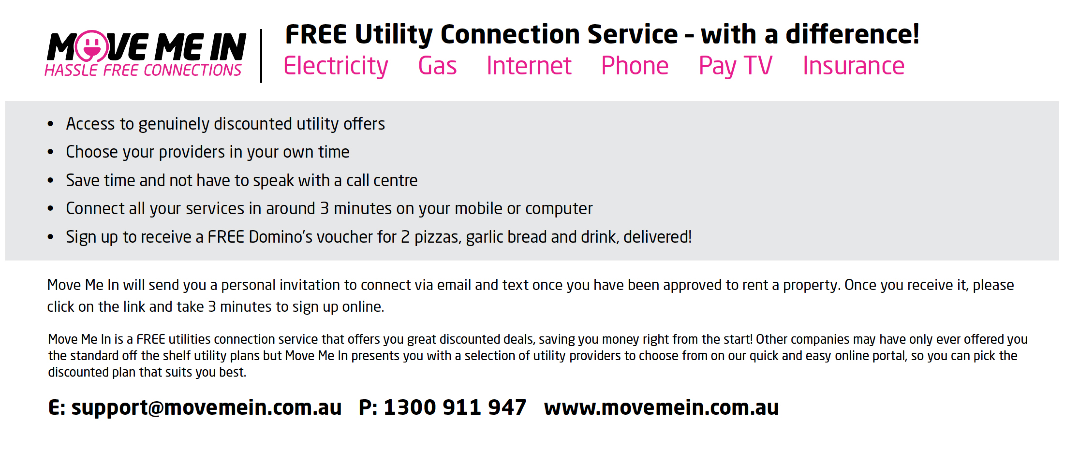

We can refer you for the above utilities to ‘Move Me In’ – it is a free service and if you decide to sign up you will receive a Free Domino’s voucher for 2 x pizzas, garlic bread and a drink, delivered!

Please send an email to sales@johnmooneyrealestate.com.au if you would like us to register you for this great service.

• Registration, Driver’s licence - https://www.service.nsw.gov.au/transaction/change-address-and-contact-details-driver-licence-vehicle-registration-or-other-road

• Third Party Insurance, Comprehensive Insurance, NRMA membership.

• My Gov (Centrelink, Medicare, ATO, Child Support Agency, Etc)

• House and Contents insurance

• Electoral roll - https://www.aec.gov.au/enrol/update-my-details.htm

• Redirect mail - https://auspost.com.au/receiving/manage-your-mail/redirect-hold-mail/redirect-mail